The Emergency Fund Isn't About Emergencies. It's About Options.

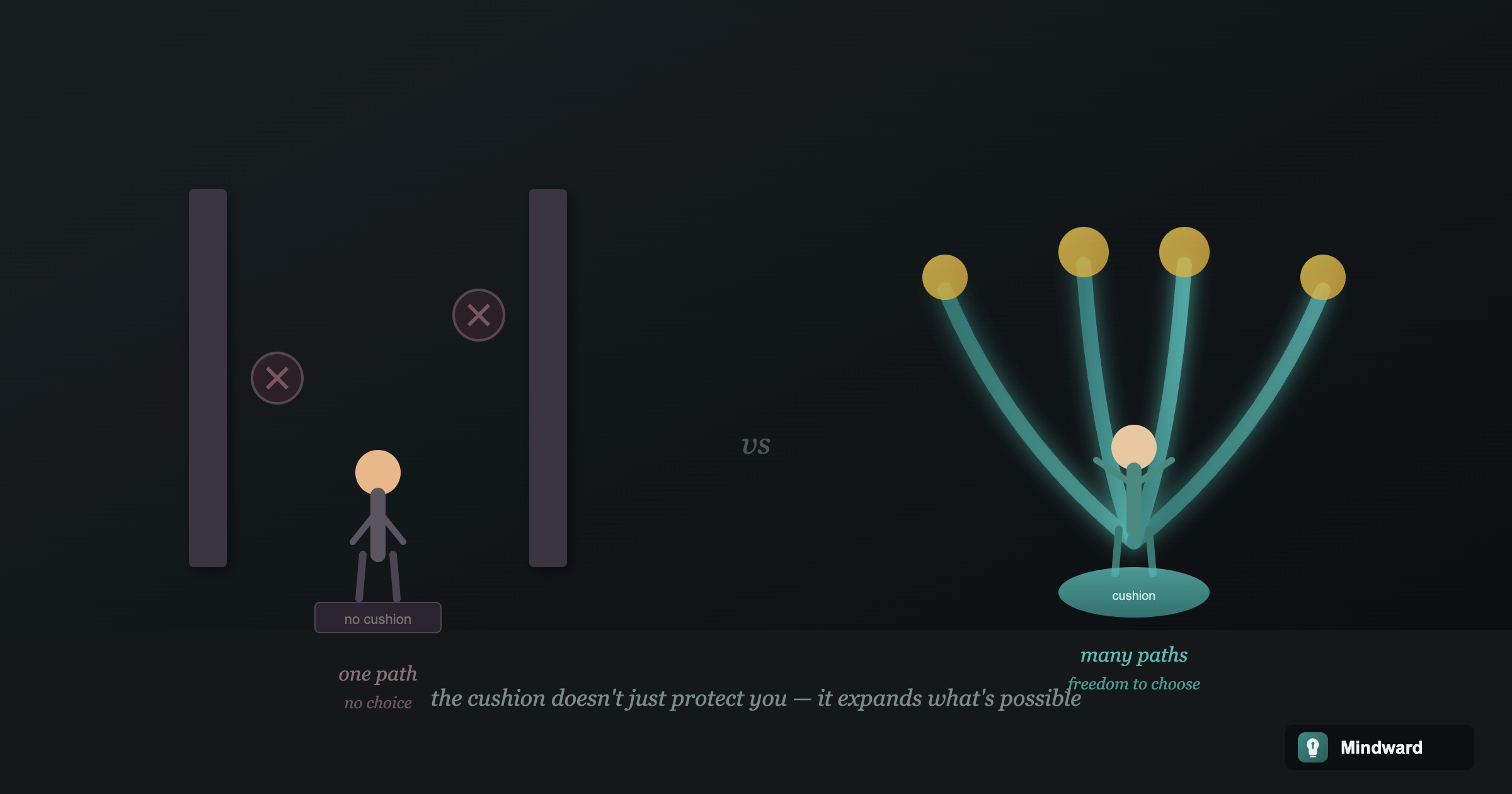

That savings cushion isn't just protection against disaster. It's the foundation of every choice you get to make freely.

The standard advice says to save three to six months of expenses for emergencies. Job loss. Medical bills. Car repairs. The framing is defensive—save this money so bad things don't ruin you.

That framing isn't wrong, but it's incomplete. It positions your savings as a shield against disaster, which makes building it feel like preparing for something you hope never happens. No wonder it's hard to stay motivated.

Here's a better way to think about it: the emergency fund isn't really about emergencies. It's about options. And options change everything.

What the Cushion Actually Buys

Money in reserve doesn't just protect you from catastrophe. It changes the way you move through every decision, every negotiation, every opportunity that comes your way.

When you have a cushion, you can say no to work that drains you. You can wait for the right opportunity instead of grabbing the first one. You can negotiate from strength instead of desperation. You can take a calculated risk without betting everything.

The cushion buys you time—and time is what turns reactive decisions into thoughtful ones. It's the difference between choosing and settling.

The Hidden Tax of Living Without Margin

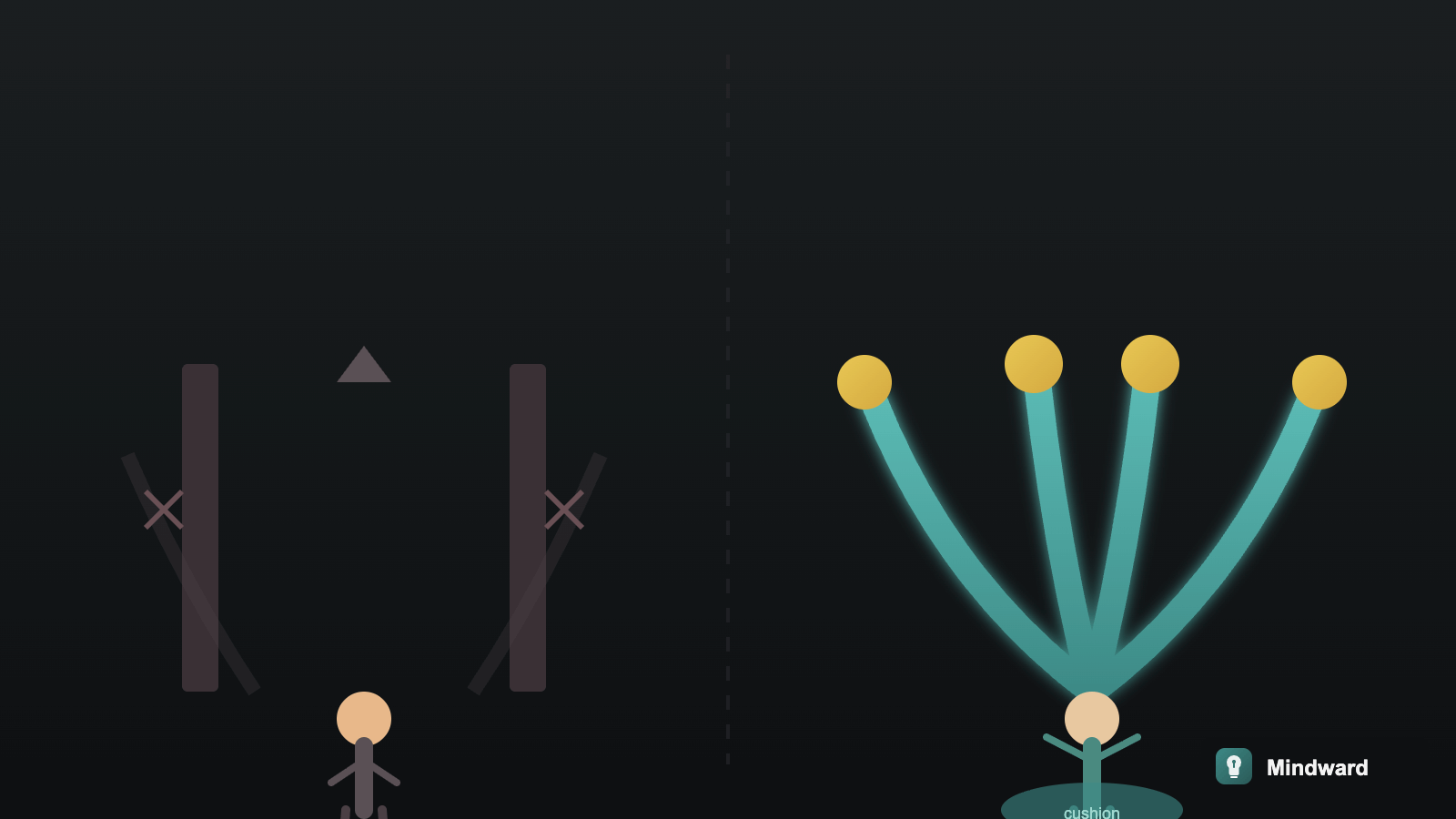

When you have no financial buffer, every decision carries extra weight. You can't afford mistakes. You can't afford to wait. You can't afford to say no.

This creates a hidden tax on your life. You take the job you don't want because you need the paycheck. You stay in situations longer than you should because leaving feels too risky. You make short-term choices that cost you in the long run because you don't have the luxury of thinking long-term.

The absence of a cushion doesn't just leave you vulnerable to emergencies. It constrains your entire decision-making landscape. Every choice is filtered through scarcity.

Without margin, you're always playing defense. With margin, you get to play offense.

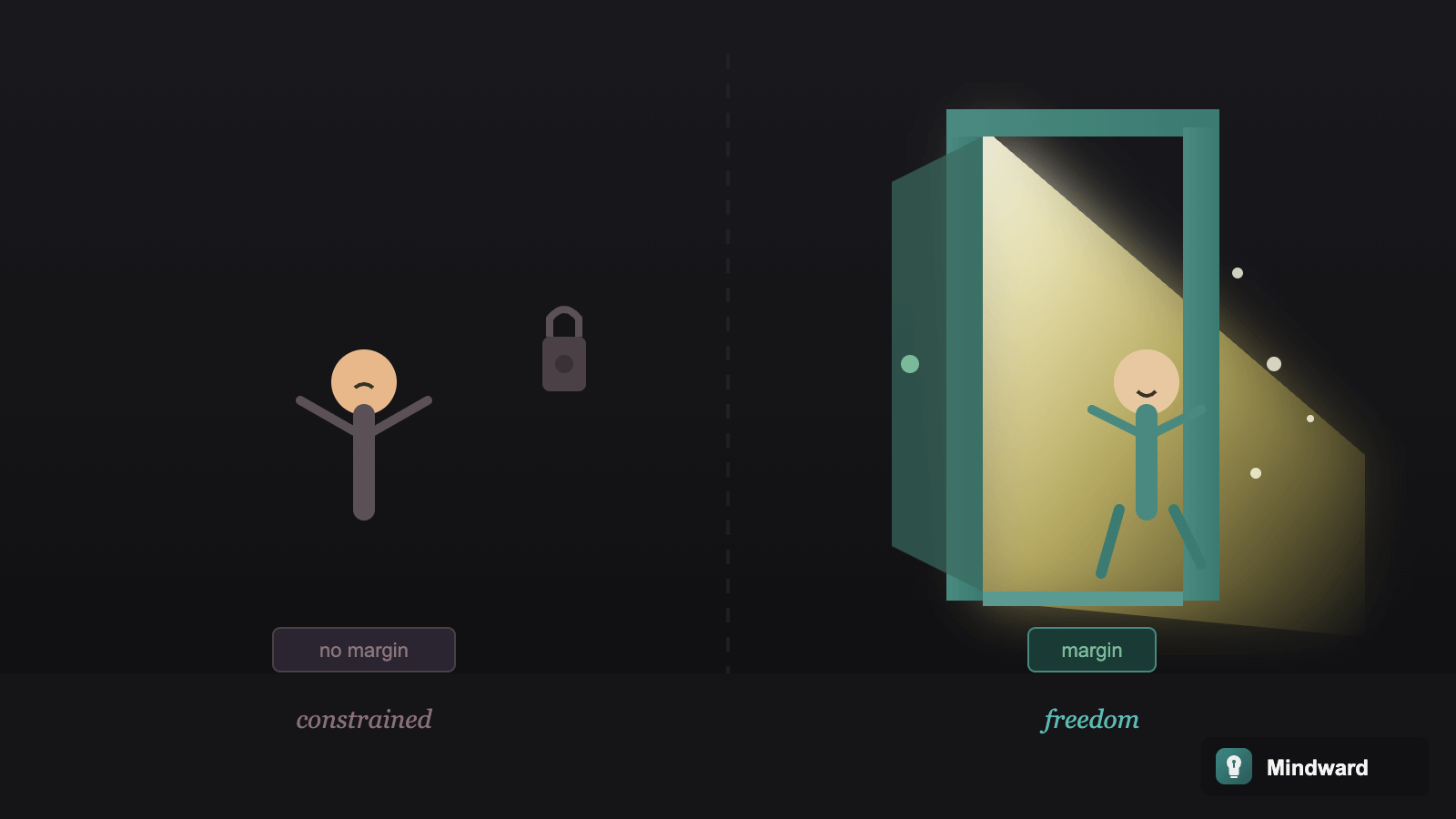

Freedom Is the Real Goal

Reframe the emergency fund as a freedom fund. Not money you're hoarding against disaster—money that expands what's possible for you.

This shift matters psychologically. Saving for emergencies feels like preparing for loss. Saving for freedom feels like building toward gain. One is motivated by fear; the other by aspiration. Both end up in the same place financially, but one is far easier to sustain.

When you see the cushion as freedom, you stop resenting the money you're setting aside. It's not money you can't spend—it's money buying you something more valuable than any purchase: the ability to choose.

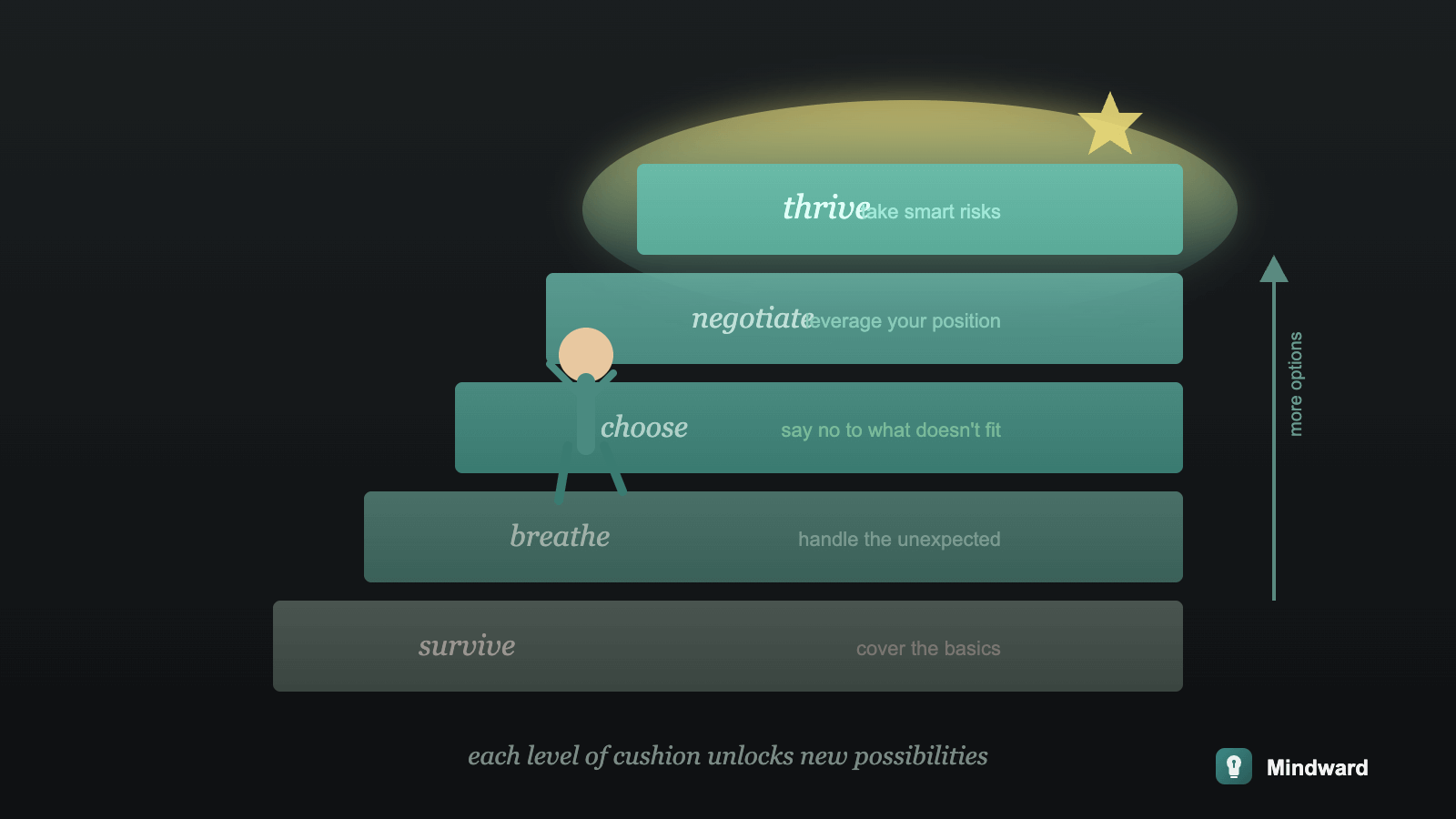

How Options Compound

Here's what most people miss: options create more options. When you have the freedom to wait, you often end up with better opportunities. When you can negotiate without desperation, you get better terms. When you can take smart risks, some of them pay off.

The person without a cushion takes the first offer. The person with a cushion can hold out for the right one. Over time, this difference compounds. Not just financially—but in career trajectory, relationship quality, and life satisfaction.

The cushion isn't just insurance. It's leverage. And leverage, used well, builds more leverage.

Building Toward Freedom

If you're starting from zero, the goal of three to six months can feel impossibly far. That's okay. Every dollar you set aside expands your options, even if it's not the full amount yet.

Start by building enough to cover one unexpected expense without panic. Then one month of breathing room. Then two. Each milestone isn't just more money saved—it's more freedom earned.

Automate the saving so you don't have to decide each month. Keep it in a separate account so you're not tempted to blur the line. Treat it like a bill you pay to your future self—the self who will have options you don't have yet.

The Peace That Comes With Margin

There's a feeling that comes with having a cushion—a background hum of security that most people don't notice until they have it. Decisions feel less fraught. Setbacks feel less catastrophic. The future feels less like a threat.

This peace isn't just emotional. It's practical. When you're not operating from scarcity, you think more clearly. You make better decisions. You're less reactive and more strategic.

The emergency fund isn't about the emergency. It's about who you get to be when you're not afraid of one.

Build the cushion. Not because something bad might happen—but because something good becomes possible when you have the freedom to reach for it.

Comments

How did you like this article?

No comments yet. Be the first to share your thoughts!